Commodity Watch: If I had a Nickel…

PORTFOLIO MANAGER

Ahmad is the President and portfolio manager for Gemcorp Capital Advisors LLC, based in New York.

Ahmad has spent most of his career in the global credit markets. Prior to Gemcorp, Ahmad was President of Pandion Mine Finance and RiverMet Resource Capital, LP - a fund focused on investing in precious metals, where he was responsible for managing the investments and the day-to-day operations of the registered investment adviser.

The tale of two systems continues. While many mining companies and investors continue to retreat and retrench some are consolidating their influence across supply chains necessary for the functioning of a modern economy.

Last month, Chinese mining conglomerate (zinc, copper and cobalt) MGG agreed to buy Anglo American’s nickel operations in Brazil for $500m. The sale was part of Anglo’s efforts to shrink its portfolio after rejecting BHP Billiton’s takeover offer. The resource sold is one of the few profitable operations at current nickel prices and may contain the third-largest resource globally.

Why does it matter?

Nickel is a key industrial component of modern economies. Although, nickel has more recently been associated with batteries, two-thirds of nickel use is in stainless steel. Stainless steel is a vital industrial material. Because of its strength and its resistance to corrosion, stainless steel is integral for infrastructure projects (housing, bridges, ports and water sanitation), chemical plants (storage tanks) and data centers (key to liquid cooling systems). As investors raise capital to invest in infrastructure projects and data centers, they might be unable to actually build those projects without a steady and reliable supply of stainless steel. In turn, without a steady supply of nickel, stainless steel cannot be produced. Supply chains matter.

Nickel also increases the density of batteries, allowing for longer use. Without it, EV distance and renewable storage capacity will be constrained. Most of the growth in demand for nickel since 2014 has been due to the demand for battery production. As utilities seek to balance intermittent energy, nickel becomes more important.

That said, the MGG acquisition serves to increase concentration across the nickel supply chain, making it more susceptible to supply shocks. The nickel market is already concentrated, with Indonesia producing over 51% of the world’s output and Chinese companies controlling over 75% of the processing. More importantly, the largest Western mining companies have been shuttering or suspending their nickel operations. BHP closed its operations in Australia and Vale is seeking a strategic review of their Canadian production facility.

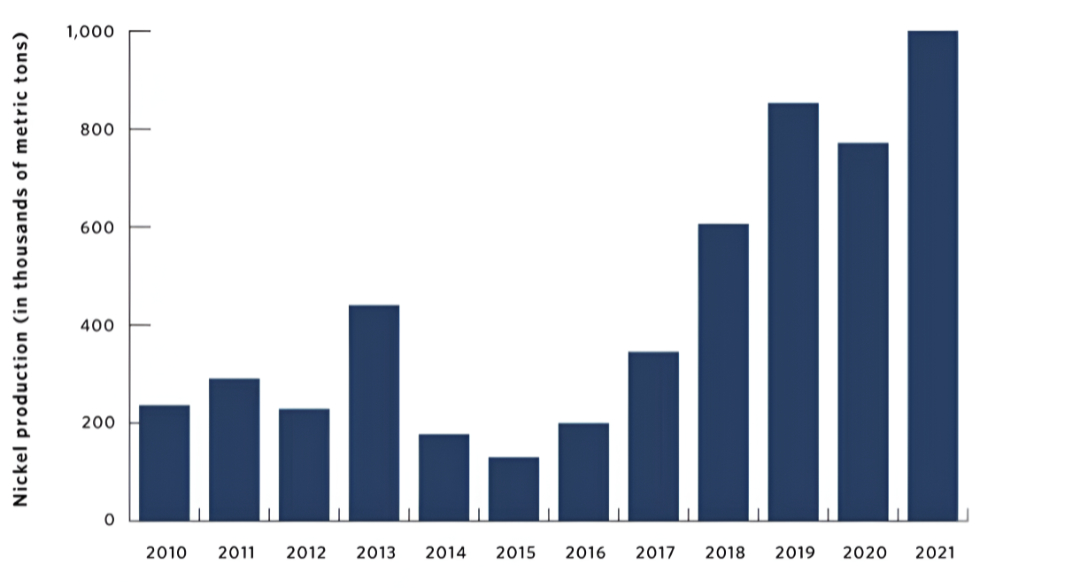

Indonesia's Nickel Mine Production 2010-2021

Source: "Mineral Commoditiy Summaries 2022," U.S. Geological Survey, January 31, 2022, https://doi.org/10.3133/mcs2022.

*Note: Value for 2022 is estimated

Despite the challenges, the current moment does not have to dictate the future trajectory. After all, in 2014 Indonesia supplied only ~5% of the world’s nickel. Through industrial and trade policy it has been able to 10x its market share (see chart) and become a significant participant in the nickel trade. Western countries have the capital markets and raw materials to push back and build their own supply chains that are strategic, resilient and profitable. The opportunity is significant. But so is the current apathy. When will attitudes change?

Other Insights

Commodity Watch: Commodities & Dollar Tango

In 1970, the US was running out of gold. The US dollar (USD) had been pegged to gold at $35/oz since the end of WWII, but USD supply increased as the US printed it for foreign aid, foreign investments and the Vietnam war.

Commodity Watch: Tariffs & Trade Finance

New changes in trade flow may affect producers, consumers and financiers in significant ways. This also however creates opportunities for funders that understand how to capitalize on the shifting dynamics.

Commodity Watch: Whither the Weather?

Markets are pricing weather volatility. Hedge funds are hiring atmospheric scientists to model the impact of weather on commodity prices at 10x their typical average salary as scientists, with total compensation upwards of $1m